BTC Price Prediction: How High Will Bitcoin Go in 2025?

#BTC

- Technical Outlook: BTC tests key moving averages amid bullish MACD crossover.

- Institutional Catalysts: CoinShares and Ark Invest reinforce long-term price targets.

- Risk Factors: Reserve Risk Indicator and mining profitability suggest near-term volatility.

BTC Price Prediction

BTC Technical Analysis: Key Indicators to Watch

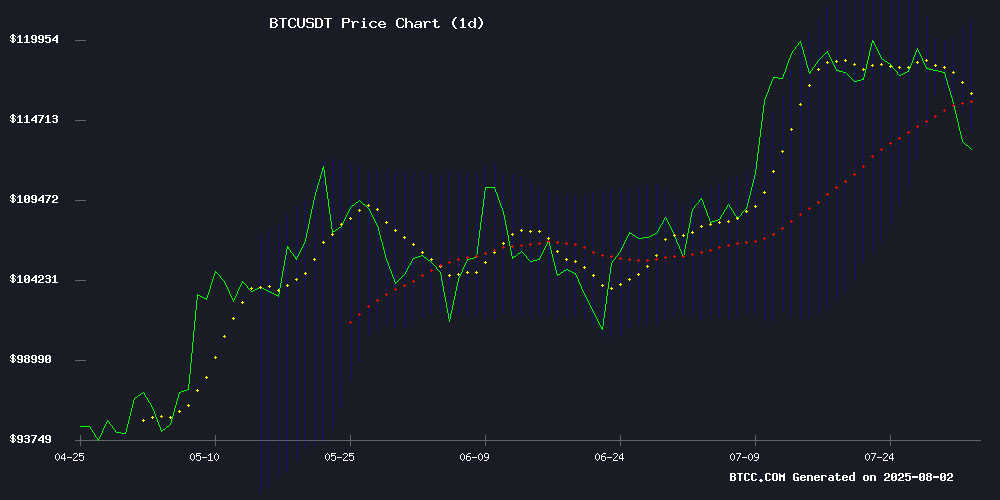

According to BTCC financial analyst John, Bitcoin (BTC) is currently trading at 112,779.45 USDT, below its 20-day moving average (MA) of 117,675.68. The MACD indicator shows a bullish crossover with a value of 805.61, while the Bollinger Bands suggest potential volatility with the upper band at 121,285.27 and the lower band at 114,066.10. John notes that a break above the 20-day MA could signal a bullish reversal, but caution is advised as the price remains in a consolidation phase.

Market Sentiment: Institutional Demand Fuels Bitcoin Optimism

BTCC financial analyst John highlights growing institutional interest in Bitcoin, as evidenced by CoinShares' report and Cathie Wood's reiterated $1.5M price target by 2027. However, mixed signals such as the Reserve Risk Indicator hint at a potential market top. John emphasizes that while bullish narratives dominate, investors should remain vigilant amid economic uncertainties.

Factors Influencing BTC’s Price

Bitcoin's Growth Potential Highlighted by CoinShares Report

CoinShares, a leading digital asset investment firm, projects Bitcoin could surge beyond its current valuation by capturing a fraction of global liquidity and the gold market. The report estimates a potential unit price of $189,000 if Bitcoin secures 2% of the $127.3 trillion global M2 supply and 5% of the $23.9 trillion gold market.

Using the Total Addressable Market (TAM) model, the analysis underscores Bitcoin's asymmetric upside. While institutional adoption remains nascent, even marginal shifts in capital allocation could catalyze exponential growth. "Gold's store-of-value narrative is now shared by Bitcoin," the report implies, without directly comparing the assets.

The findings arrive as Bitcoin demonstrates renewed momentum, with analysts increasingly viewing it as a macroeconomic hedge. CoinShares' scenario-based approach provides a framework for evaluating Bitcoin's long-term trajectory amid evolving monetary landscapes.

Davinci Warns Investors: 'You Don’t Own Enough Bitcoin' as Institutional Demand Grows

Bitcoin maximalist Jeremie Davinci has issued a stark warning to retail investors, declaring they remain under-exposed to BTC amid accelerating institutional accumulation. His August 2025 tweet—"You still don’t own enough bitcoin for what’s coming"—signals a supply crunch as ETFs, corporations, and nation-states aggressively stack sats.

The early adopter, who famously advocated $1 Bitcoin purchases in 2013, now frames BTC as a generational wealth preservation tool. His decade-long thesis positions the asset as a "freedom provider" akin to the internet's disruptive potential, with price projections reaching $500,000 by 2030.

Jetking Infotrain Adopts Daily Bitcoin Accumulation Strategy with 21,000 BTC Target by 2032

Indian IT training firm Jetking Infotrain has unveiled an ambitious plan to accumulate 21,000 Bitcoin by 2032 through a disciplined daily purchasing strategy. The company's Joint Managing Director Siddarth Bharwani revealed the "Daily Buy At Any Price" (D-BAAP) approach, converting operational surplus into BTC regardless of market conditions.

Jetking currently holds 23 BTC, acquired through capital raises including a ₹6.1 crore preferential issue in May and a ₹11.5 crore equity offering in July. Bharwani predicts Bitcoin could surpass ₹10 crore per unit by their target date, framing the accumulation as a long-term value play rather than speculative trading.

Cathie Wood Reiterates $1.5M Bitcoin Price Target by 2027 Amid Institutional FOMO

Ark Invest's Cathie Wood doubled down on her bullish Bitcoin outlook during a discussion with Altcoin Daily, predicting the cryptocurrency could reach $1.5 million by 2027. The forecast hinges on growing institutional adoption and Bitcoin's inherent scarcity—only 21 million will ever exist, with 19.66 million already mined.

Wood emphasized Bitcoin's evolving role as a non-correlated asset class, particularly as traditional stocks and bonds move in lockstep. "Institutions are waking up to Bitcoin's unique value proposition," she noted, pointing to on-chain data showing long-term holders refusing to sell despite price appreciation. "This diamond-handed behavior signals conviction that institutional capital is just starting to flow in."

MicroStrategy's Michael Saylor, whose firm holds over 628,791 BTC (3% of total supply), framed Bitcoin as the digital successor to analog stores of value. "Gold, real estate, even equities—they're all being demonetized by Bitcoin," Saylor argued. The panel consensus suggested 2024 might represent the last buying opportunity before Wall Street's full-scale embrace sends prices parabolic.

Former UK Cop Jailed for Stealing 50 Bitcoin

A former UK police officer has been sentenced to 5.5 years in prison for stealing and laundering 50 Bitcoin during a dark web investigation. The theft, which went undetected for years, shocked authorities as it involved a law enforcement officer profiting from seized crypto assets.

The case highlights the challenges of monitoring illicit activity in the cryptocurrency space, even among those tasked with upholding the law. Bitcoin's pseudonymous nature initially allowed the officer to conceal the theft, but forensic tracing eventually led to his conviction.

Bitdeer Increases Bitcoin Holdings, Now Holds 1,675.9 BTC

Bitdeer has bolstered its Bitcoin reserves by acquiring an additional 38 BTC, bringing its total holdings to 1,675.9 BTC. The move underscores the mining firm's unwavering confidence in Bitcoin as institutional interest grows and the market matures.

As a dominant player in crypto mining, Bitdeer's strategic accumulation reflects a deliberate effort to fortify its digital asset portfolio. Market observers interpret these purchases as a bullish signal for Bitcoin's long-term viability amid an evolving cryptocurrency landscape.

Sustainable Crypto Mining Breakthrough: AIXA Miner Leads Green Revolution in 2025

The cryptocurrency mining industry faces mounting scrutiny over its environmental impact, but AIXA Miner emerges as a game-changer in 2025. This AI-powered cloud mining solution operates entirely on renewable energy, challenging the fossil fuel-dependent status quo of Bitcoin mining.

By leveraging artificial intelligence for load balancing and eliminating hardware requirements, AIXA Miner demonstrates that profitability and sustainability aren't mutually exclusive. The platform's dual focus on financial security and ecological responsibility represents a paradigm shift in crypto asset generation.

As climate concerns dominate global discourse, such innovations may redefine mining's role in the digital asset ecosystem. AIXA Miner's approach could pressure traditional operators to adopt cleaner energy solutions or risk obsolescence.

Crypto Markets Plummet as Economic Signals Shake Sentiments

Cryptocurrency markets are experiencing significant volatility as macroeconomic indicators signal potential turbulence ahead. Bitcoin (BTC) recently dipped from $115,001 to $114,000, reflecting broader market unease. The S&P 500 fell 2%, while crypto-related stocks like COINBASE plummeted 16%, and MSTR and Circle declined 6% and 8% respectively.

Federal Reserve Chair Powell's reluctance to cut interest rates has exacerbated the downturn. Elevated PCE data points to persistent inflation, and the Michigan Consumer Sentiment Index underperformed at 61.7 versus a forecast of 62. New tariffs suggest inflationary pressures may intensify further, compounding market jitters.

This sell-off was anticipated by analysts, with August predicted to begin on a bearish note. The convergence of weak consumer sentiment, sticky inflation, and restrictive monetary policy creates a challenging environment for crypto investors navigating these crosscurrents.

Best Crypto Presales to Watch As Bitcoin Targets $170k

Bitcoin's surge past $117,000 has shifted opportunities from established assets to early-stage presales. Investors are now scouting projects reminiscent of Bitcoin's early days, seeking exponential gains.

DeepSnitch emerges as a standout, leveraging five specialized AI agents to decode market patterns typically visible only to insiders. Its SnitchFeed tool monitors alpha groups, Telegram threads, and smart money movements in real-time, offering retail traders institutional-grade insights.

The presale, already gaining momentum, features a dynamic pricing model that adjusts with each purchase—currently climbing from $0.0151 toward $0.01540. This mirrors the urgency seen when Bitcoin traded at $1,000, now replicated in next-generation crypto opportunities.

Bitcoin’s Reserve Risk Indicator Signals Potential Market Top

Bitcoin's on-chain metrics are flashing warning signs as the Reserve Risk indicator—a key gauge of long-term holder conviction—has triggered a potential market top signal. Analyst Darkfost notes this coincides with a significant movement of aged BTC coins, a pattern historically preceding short-term corrections.

The Reserve Risk model combines Coin Days Destroyed (CDD) and its momentum (MVOCDD) to assess holder confidence relative to price. Current data from LookIntoBitcoin shows MVOCDD spiking for only the third time since 2017, with prior instances leading to notable cooling periods. The alert gains urgency as this surge occurs near Bitcoin's multi-year highs above $60,000, suggesting veteran investors may be preparing for turbulence.

Bitcoin Mining Profitability Hits Post-Halving High in July: JPMorgan

Bitcoin miners saw profitability surge to its highest level since April's halving event, according to JPMorgan analysts. Daily block reward revenue averaged $57,400 per exahash in July, marking a 4% monthly increase.

The network hashrate rebounded 4% to 899 EH/s after June's seasonal dip, while mining difficulty ended the month 9% higher. Despite the improvement, profitability remains nearly 50% below pre-halving levels when rewards were cut from 6.25 to 3.125 BTC per block.

Publicly traded miners outperformed Bitcoin's price action, with Argo Blockchain leading the group at 66% monthly gains. Core Scientific was the notable underperformer, declining 21%.

How High Will BTC Price Go?

BTCC analyst John projects a potential rally toward $170,000 if Bitcoin breaks key resistance levels, driven by institutional FOMO and post-halving supply dynamics. Below is a snapshot of critical technical levels:

| Indicator | Value |

|---|---|

| Current Price | 112,779.45 USDT |

| 20-Day MA | 117,675.68 |

| Bollinger Upper Band | 121,285.27 |

| MACD Signal | Bullish (805.61) |